irs tax levy form

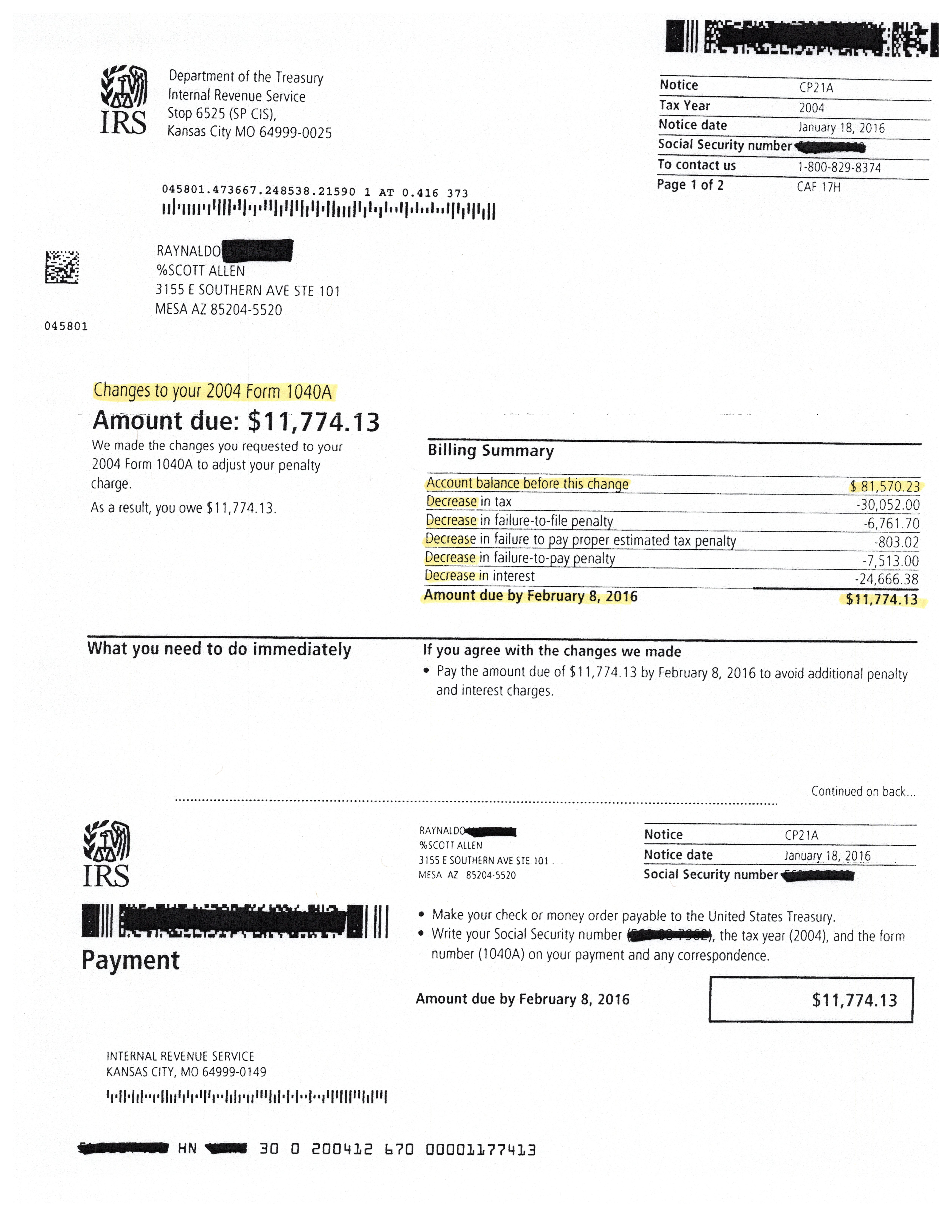

The Form 668-A Notice of Levy is sent by the IRS to collect back taxes through an account receivables or bank freezing the funds held in that account. The Internal Revenue Code IRC authorizes levies to collect delinquent tax.

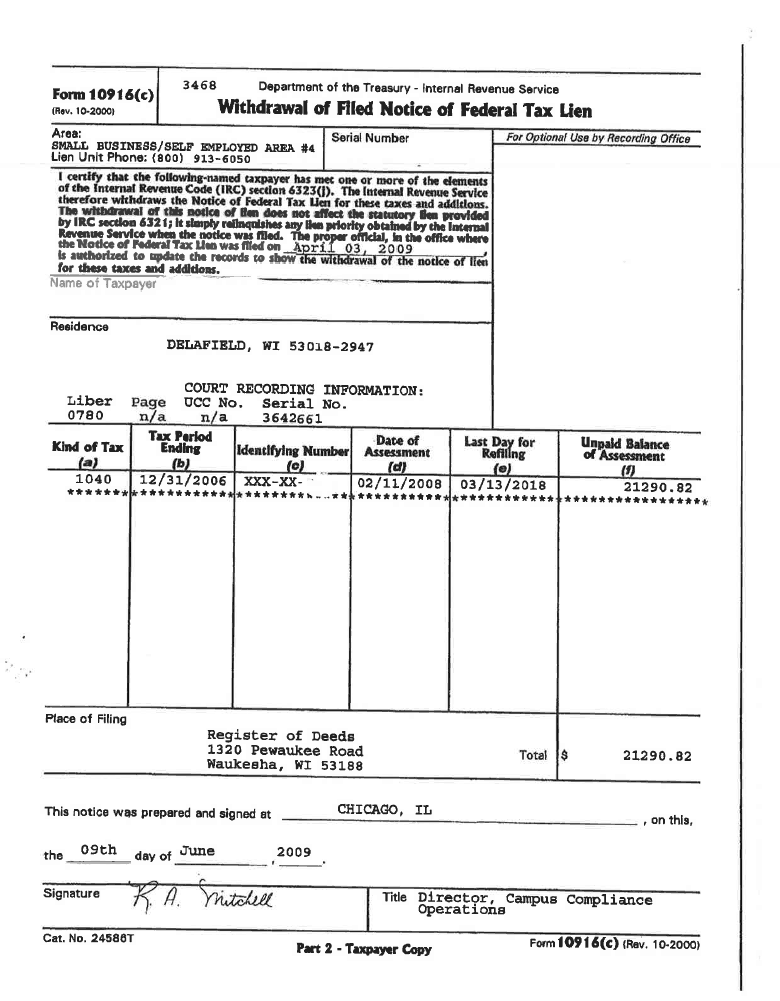

Form 12474 A Revocation Of Certificate Of Release Of Federal Tax Lien

As result the IRS has taken.

. Space on Parts 3 4 5 of the levy 53655 is exempt from this levy 50290 plus 3365. Department of the Treasury Internal Revenue Service Notice of Levy on Wages Salary and Other Income Form 668-WcDO Rev. July 2002 THIS ISNT A BILL FOR TAXES YOU OWE.

The IRS generally uses Form 668W ICS or 668-W CDO to levy an individuals wages salary including fees bonuses commissions and similar items or other income. Your employer will use it Form 668-W to compute the exempt amount. Thats because the levy is actually served on your bank you just get a copy of it.

You may be reimbursed for bank charges caused by erroneous levies by submitting Form 8546 Claim for Reimbursement of Bank Charges PDF to the IRS address on your copy of. When and if it needs to take enforced collection action against the taxpayer the IRS simply retrieves it from its data base. A taxpayer who is married files jointly is paid bi-weekly and claims two dependents has.

Ad Be Proactive Rather Than Reactive. Contact the IRS immediately to resolve your tax liability and request a levy release. We Offer A Free IRS Transcript Report Analysis 499 Value.

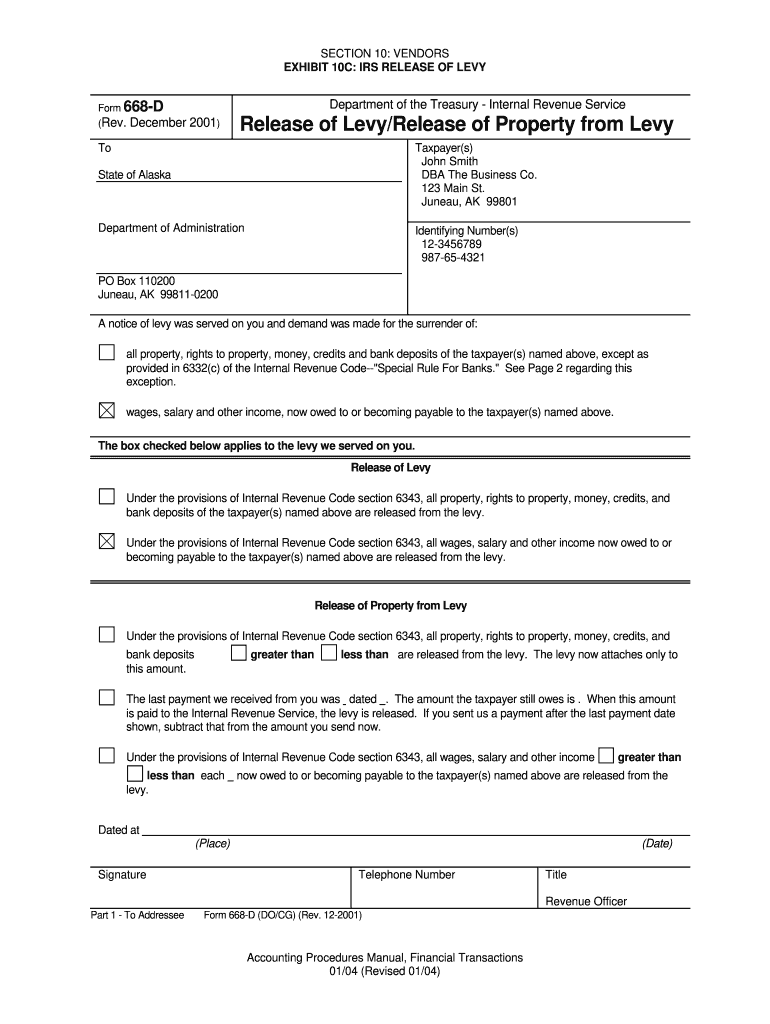

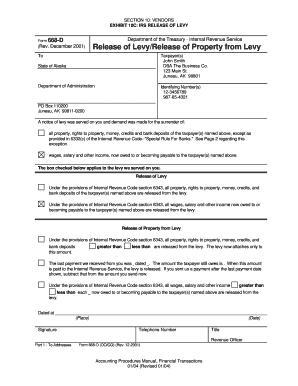

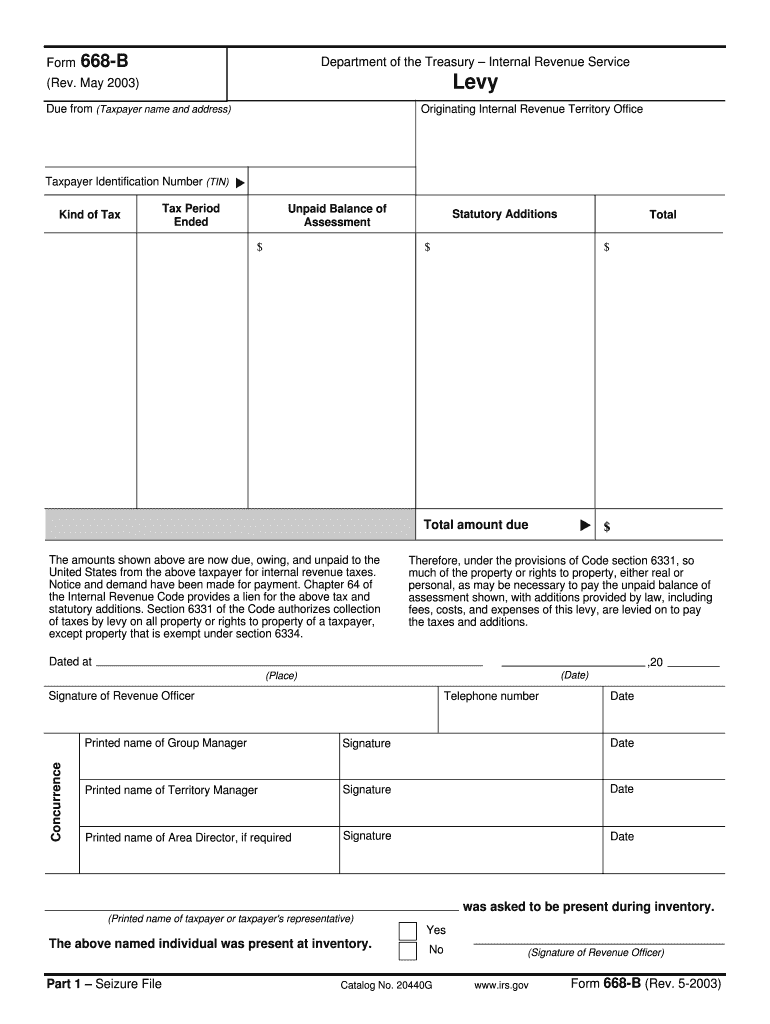

The levy is not continuous and only affects the money in the account on the day the levy is acted upon. Levy Relief Form 668-A Notice of Levy bank Form 668-B Levy seize a taxpayers property Form 668-D Release of Levy Release of Property from Levy third party holders of. Where does Internal Revenue Service IRS authority to levy originate.

Release Your IRS Tax Levy. Call For A Free Consultation. The IRS can also use the Federal Payment Levy Program FPLP to levy continuously on certain federal.

An IRS levy permits the legal seizure of your property to satisfy a tax debt. The IRS used Form 8519 to notify you and your financial institution of a levy. Form 8519 is very.

The IRS Form 8519 you receive may be entitled Taxpayers Copy of Notice of Levy. A levy on third parties is executed by service of form 668-A. But its not permanent.

You have unpaid IRS back taxes. The IRS can also release a levy if it determines that the levy is causing an immediate economic. No arrangement was made to resolve the IRS back taxes.

Book A Consultation Today. Collection Appeal Request February 2020 Department of the Treasury - Internal Revenue Service Instructions are on the reverse side of. It can garnish wages take money in your bank or other financial account seize and sell your.

NOTICE OF LEVY Why are you receiving this letter.

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Leins 9 Ways To Resolve Tax Leins Irs Tax Lien Help Faith Firm

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Tax Lien Versus Irs Tax Levy

Form 668 D Pdf Fill Online Printable Fillable Blank Pdffiller

Irs Notice Cp504 Notice Of Intent To Seize Your Property H R Block

Notice Cp504b What It Means How To Respond Paladini Law

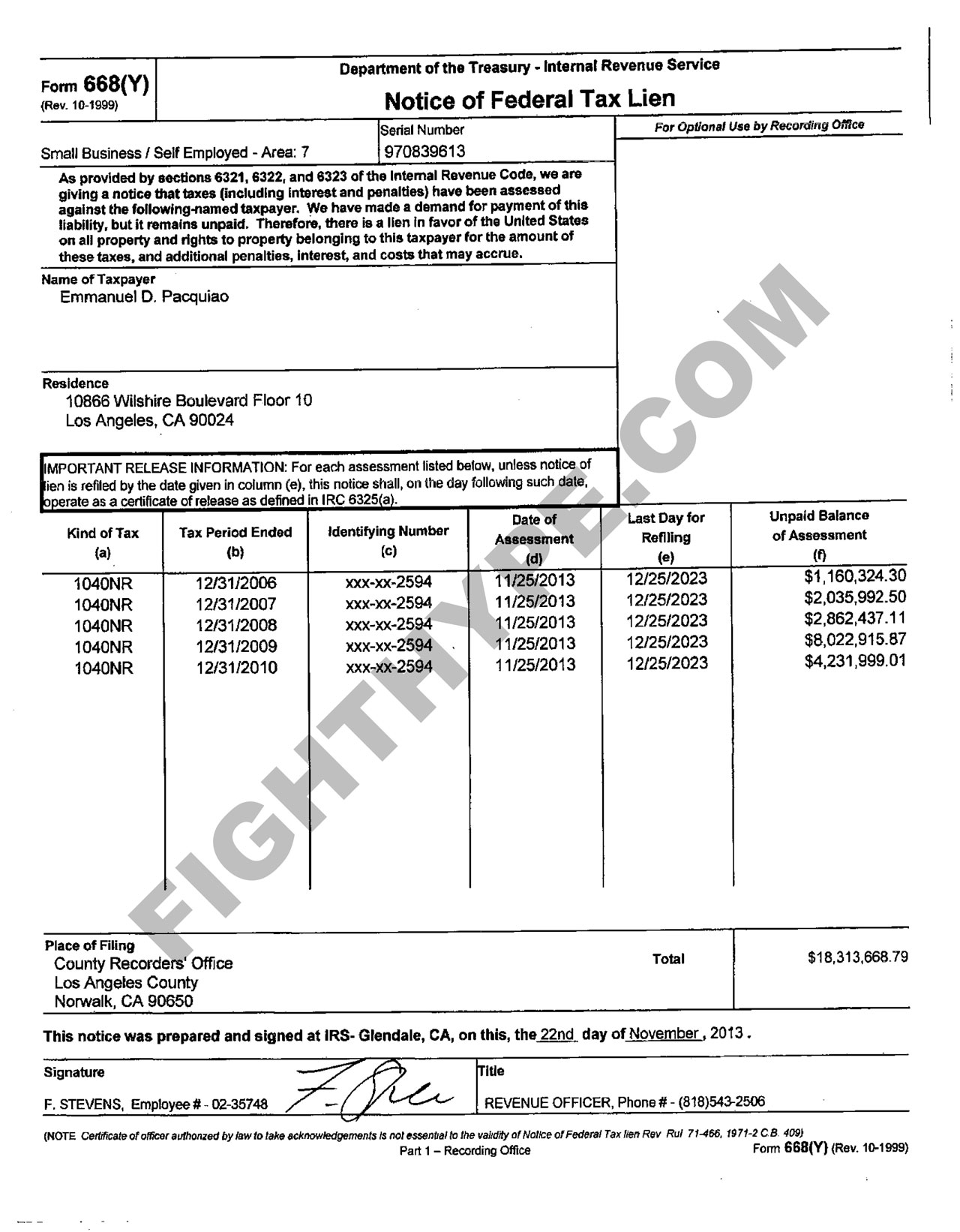

Irs Notices Form 668 Y C Understand Form 668 Y C Lien Notification

Stop Irs Levy Now Stop Irs Wage Garnishment

Form 668 D Fill Out And Sign Printable Pdf Template Signnow

5 12 3 Lien Release And Related Topics Internal Revenue Service

2003 2022 Form Irs 668 B Fill Online Printable Fillable Blank Pdffiller

5 19 9 Automated Levy Programs Internal Revenue Service

Irs Notices And Letter Form 668 A C Understanding Irs Notice 668 A C Notification Of Levy