child tax credit october payments

How Much Will I Receive For My October Child Tax Credit Payment. 15 by direct deposit and through the mail.

Childctc The Child Tax Credit The White House

For example the maximum monthly payment for a family that received its first payment in October is 500-per-child for kids ages 6 through 17 and 600-per-child for kids.

. The Internal Revenue Service IRS is set to start sending child tax credit. CBS Detroit --The Internal Revenue Service IRS sent out the fourth round advance Child Tax Credit payments on October 15. Once all of the payments are issued about 15 billion in advanced tax credit money will.

The IRS is planning to issue three more monthly payments this year. The deadline to opt out of Octobers payment has already passed. The next payment goes out on Oct.

The actual time the check arrives depends. For October most families were slated. In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion.

THE Internal Revenue Service IRS sent out child tax credit payments on Friday but some families claim they havent received them yet. The monthly checks of up to 300 per child will continue through the end of 2021. CBS Detroit --Most parents will receive their next Child Tax Credit payment on October 15.

The monthly child tax credit payments have come to an end but more money is coming next year. For October most families were slated. October 29 2021.

The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021. However if you still havent received any checks or if youre missing money. As part of the.

This is the fourth batch of advanced monthly payments for the expanded Child Tax Credit. Typically you can expect to receive up to 300 per child under age of 6 250 per child ages 6 to 17. IR-2021-201 October 15 2021.

152 PM EDT October 15 2021. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. The Child Tax Credit reached 611 million children in.

THE Internal Revenue Service IRS sent out child tax credit payments on Friday but some families claim they havent received them yet. The House of Representatives passed. What are the payment dates for child tax credit checks.

The Child Tax Credit Non-Filer Sign-Up Tool is to help parents of children born before 2021 who dont typically file taxes but qualify for advance Child Tax Credit payments. There are still a few more child tax credit payments set to go out to qualifying. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now.

Currently the advance monthly child tax credit payments that many American families may have gotten used to in 2021 have expired. MILLIONS of Americans are set to receive hundreds of dollars of child tax credit payments this week. The fourth round of child tax credit payments up to 300 will be sent out on October 15 Credit.

Thats an increase from the regular child tax. The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and through the.

You Will Not Get Another Chance To Extend Filing Your 2020 Taxes By October 15 2021 Everyone Must Have Small Business Growth Tax Payment Business Growth

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

The Irs Refund Schedule 2021 Tax Deadline Tax Return Tax Return Deadline

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

F Y 2016 17 Due Dates Of Service Tax Tds Tcs Central Exxcise Cst Vat Pt Esic Pf Accounting Taxation Tax Due Date Tax Payment

50 000 Spouses To Get Catch Up Economic Impact Payments Income Tax Return Catch Tax Refund

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

How To File Previous Year Taxes Online Priortax Online Taxes Previous Year Tax

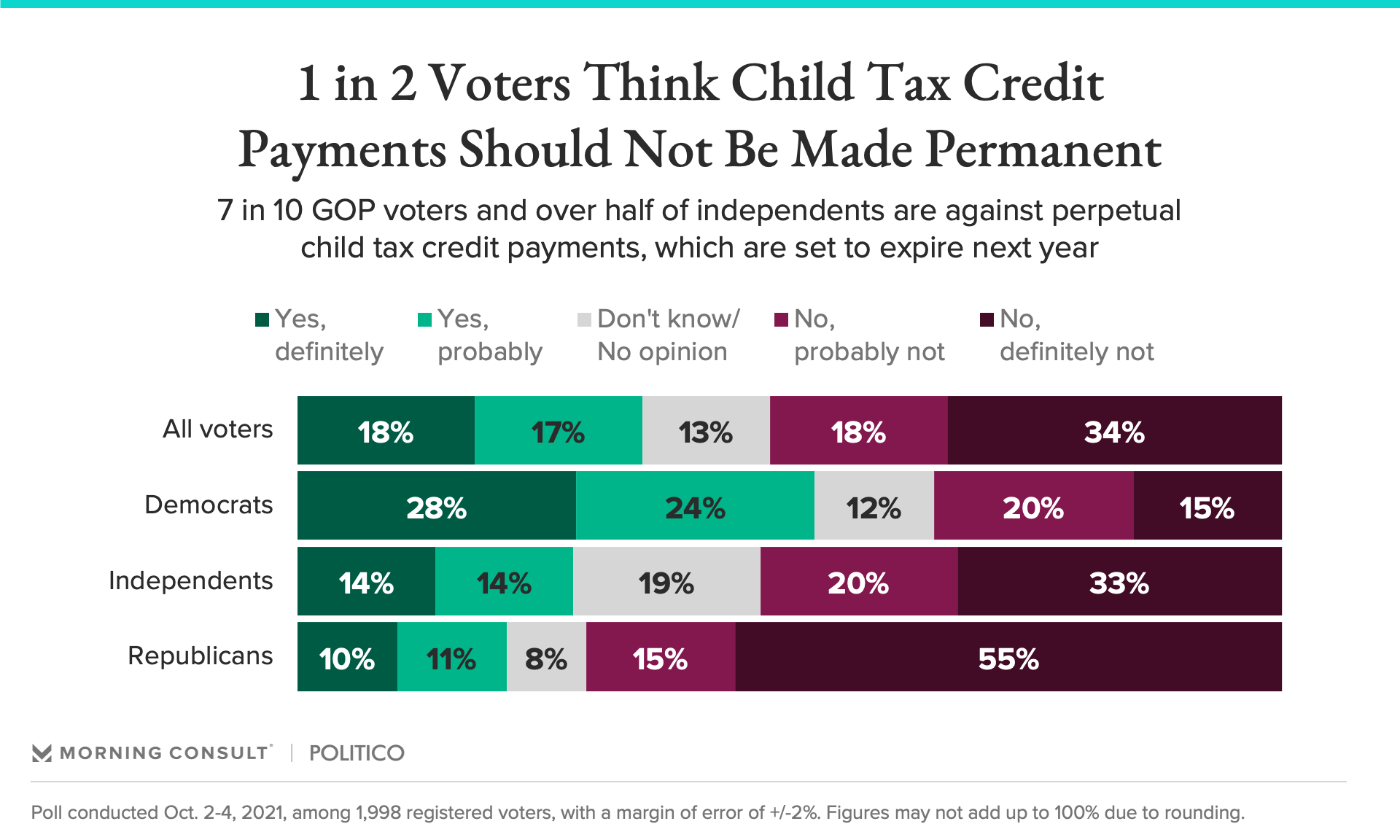

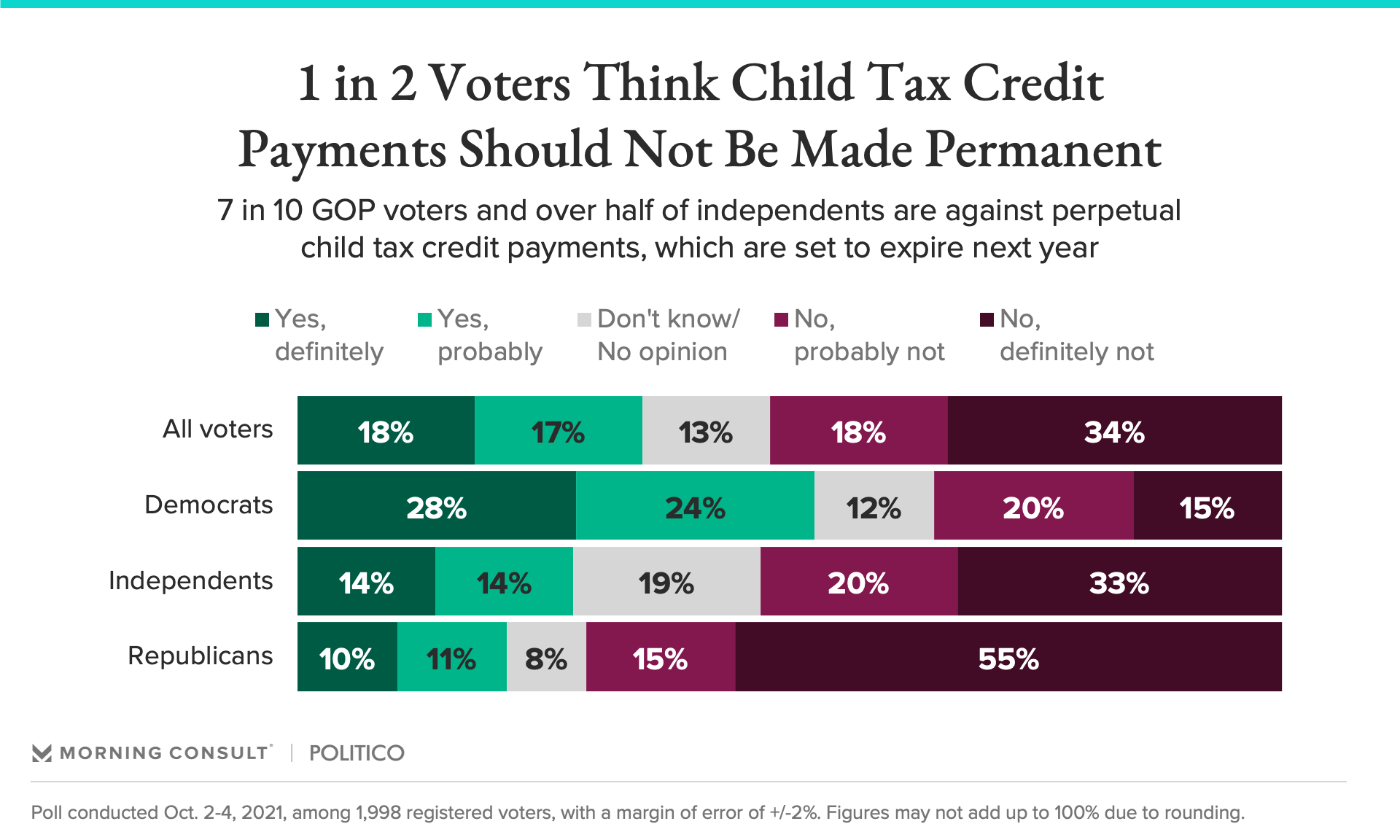

Who Gets Credit For The Expanded Child Tax Credits For Voters Across Parties Democrats And Biden Take The Prize

Itr 6 Available Now Income Tax Return Tax Deducted At Source Tax Refund

Remaining Child Tax Credit Money Don T Miss An Extra 1 800 Per Child Cnet

October Is Tax Month Now Social Media By Rgsc Chartered Accountants Infographic Http Bit Ly 2mvuxof Infographic Infographic Marketing Social Media

2021 Child Tax Credit Advanced Payment Option Tas

October Child Tax Credit Payment Kept 3 6 Million Children From Poverty Columbia University Center On Poverty And Social Policy

Explainer What Are The Child Tax Credits Democrats Are Battling Over Reuters

Form 1099 K Explained The Micro Payment Middle Man Filing Taxes Tax Help Money Saving Tips

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities